Blue Haven Initiatives

Who We Are

Blue Haven Initiatives makes grants and philanthropic investments into organizations and companies with clearly defined impact missions. We consider funding opportunities in three distinct impact categories: Impact Investing Ecosystem Building, Human Capital Development, and Catalytic Investments.

Impact Investing ecosystem

The family started their impact investing journey nearly ten years ago. Along the way, they benefitted from research, tools and peer networks that make the field more accessible. The Initiatives team recognizes the critical role grant capital can play in supporting the continued advancement of impact investing. We partner with organizations that are building communities, conducting research and developing robust tools to encourage new or inform existing impact investors.

Human Capital Development

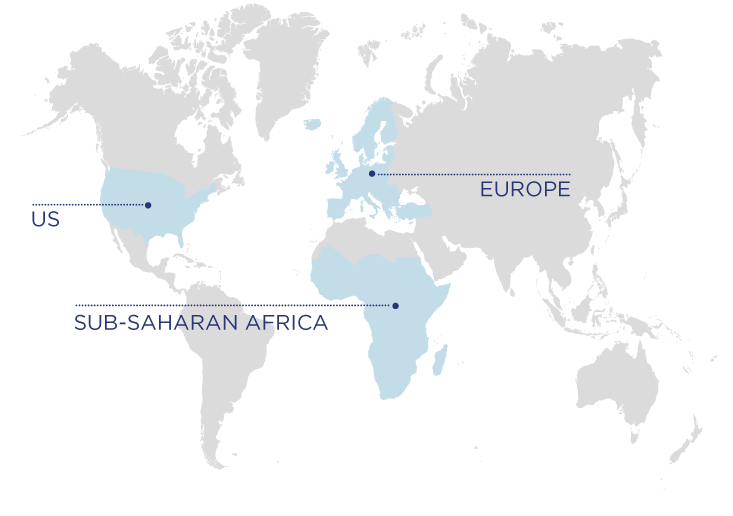

Our Ventures team has worked closely with early-stage companies across Sub Saharan Africa for several years. While startups often face obstacles in finding the right teams, companies in our focus geographies are at a particular disadvantage due to an underdeveloped ecosystem. Blue Haven considers grant funding for organizations committed to helping companies recruit a diverse talent pool with 21st century employment skills; re-reskill and retain existing employees; develop executive leadership and professional development opportunities; and foster a healthy organizational culture. If we believe innovative companies that target underserved consumers can deliver impact (and we do), then we want those companies to have the best teams possible.

Catalytic Investments

Innovations with the greatest potential for impact often face barriers to scale that cannot be overcome with traditional capital structures. Blue Haven’s catalytic capital portfolio, a collaboration between our Initiatives and Ventures team, prioritizes these innovative solutions. As a family office with a diversified toolkit of investment and philanthropic capital, BHI aims to help companies and industries overcome barriers to scale by providing flexible, patient financing. This can mean a lot of different investment types, but think blended finance structures, first loss capital, sub-commercial debt, pay-for-success, or recoverable grants. Our team seeks out leaders challenging the status quo who have a game plan for graduating from our support by removing a barrier to scale for their organization and others within the industry.

Our Focus

Grants

Capital Type

Grants, recoverable grants

Ticket Size

$50K – $250K awards for new grantees

$100K – $500K awards for longer-term partners

Sectors

Human Capital

Ecosystem Building

Catalytic Investments

Capital Type

Debt, blended structures, pay-for-success, funds

Ticket Size

$250K investments, no follow-on funding

Sectors

Climate Change

Geographical Focus

Portfolio

Our Team

Initiatives Proposals

To submit a proposal, please fill out Blue Haven Initiative's application form and send with a cover note to: initiatives@bluehaveninitiative.com.